Throughout the past few years, the cryptocurrency industry has seen a massive level of growth in terms of cryptocurrency wallet holders, as well as overall interest within the sector.

Today, more people than ever before have sparked interest in cryptocurrencies, and they are beginning to see their global adoption increase on a daily basis. However, for many newcomers, it can be a bit intimidating at first, trying to figure out which route is best for them. As a means of clearing things up, the team at DXONE, a research-based crypto trading platform, will be going over everything you need to know about trading and investing in cryptocurrencies.

The Main Difference Between Trading and Investing

One of the key differences between cryptocurrency trading and cryptocurrency investing is the time frame associated with the process. Cryptocurrency investing is typically connected to a long-term strategy, where the investors, in this case, also known as HODLers, believe in the long-term growth of the cryptocurrencies they are holding onto and will not sell them until a predetermined time passes, despite their market volatility and price swings.

They essentially minimize trading on the short-term price movements associated with cryptocurrencies. What this means is that an investor would buy a cryptocurrency asset, based on the long-term potential it has in their eyes, with the hopes of eventually selling it in the future for a profit. This time frame typically lasts for years.

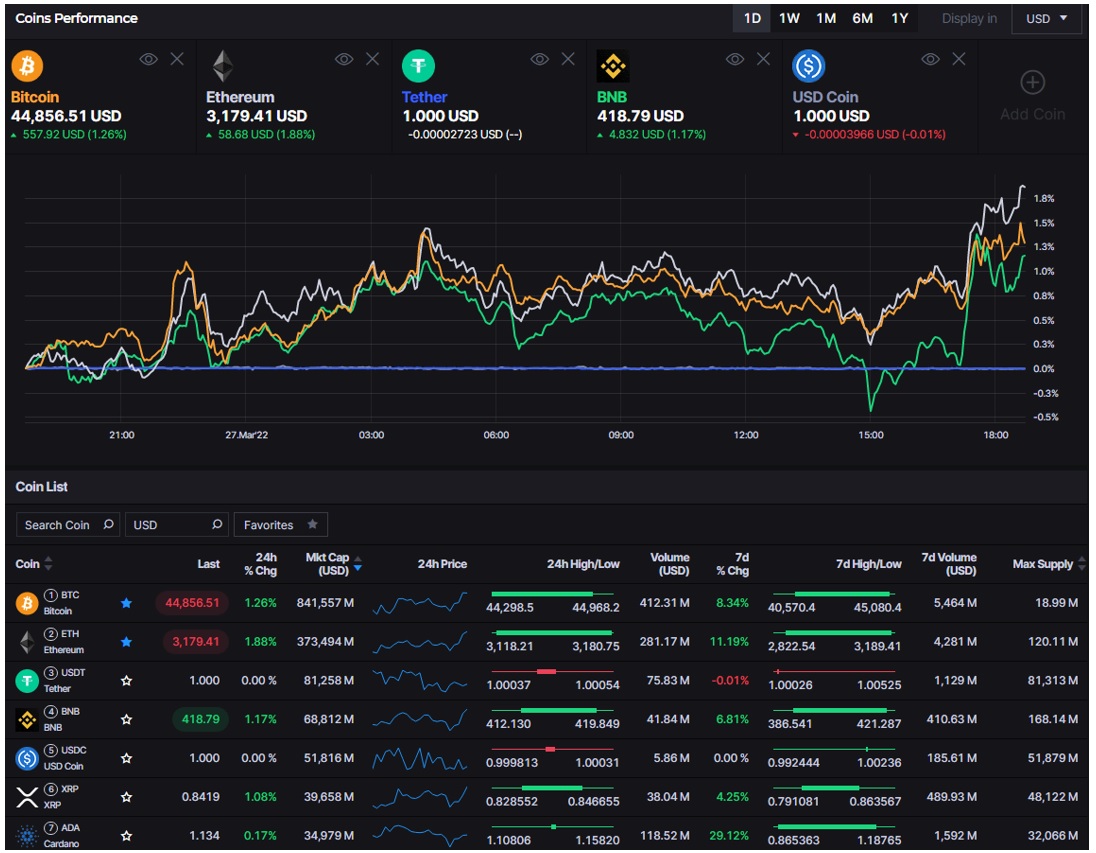

Image Source: Coin Performance Chart from the DXONE Exchange

On the other hand, when it comes to cryptocurrency trading, it is a short-term strategy that typically lasts less than a week. This is due to the fact that cryptocurrency traders are aiming to leverage the short-term volatility of crypto-asset price changes for profit.

Typically, these trading time frames range from the span of minutes to days. The rewards are experienced a lot quicker this way. However, it requires a far higher level of effort when compared to investing, mainly due to the fact that traders have to be on a consistent lookout for the price swings of cryptocurrencies. Cryptocurrency trading can be profitable due to the high volatility of the cryptocurrency market. However, this is dependent on the trader’s skill, but most importantly, their luck.

Is It Better to Be a Trader or Investor?

The answer to this question is based on a few factors. However, the most notable ones are the person’s level of experience surrounding the cryptocurrency market and their risk appetite.

If you are a newcomer to the world of cryptocurrencies, and this is your first time attempting to get engaged with the overall cryptocurrency market, in this case, it is better to be a cryptocurrency investor.

This is due to the fact that all an investor has to initially do to simply buy a specific cryptocurrency on an exchange platform such as DXONE, for example, and afterward, store or HODL the tokens within their cryptocurrency wallets until the price of the token increases.

In practice, this means that you would buy Bitcoin (BTC) or Ethereum (ETH) for a specific amount of money, and you would simply hold onto it for a year or two to hopefully sell it at a profit. This requires the least possible effort on your end, and it is an excellent way to get into buying cryptocurrencies for the very first time.

However, if you have some experience within the crypto markets, and have bought and sold some cryptocurrencies in the past for a profit, then cryptocurrency trading presents a much more appealing and lucrative option for you. This is an active method of investing, where you would have to be on the constant lookout for all and any market opportunities that might arise through utilizing charting tools found within cryptocurrency exchanges such as DXONE.

Here, you would buy a cryptocurrency token during its dip and sell it at its spike in value.

Another key difference here is the fact that cryptocurrency investors typically have a low trading frequency, as they would hold onto the assets without selling them as a means of achieving their goal throughout the span of a few years.

Traders, on the other hand, are actively buying and selling tokens due to the fact that they are keeping a consistent eye on the market price movement for opportunities through which they can make gains, no matter how small these gains are.

This gives them far more lucrative rewards. However, there is a much higher level of risk associated with it as well, and they have to constantly monitor the market.

Trading Summarized

Trading is an excellent opportunity for those with a solid risk appetite to capitalize out of the short-term market swings surrounding cryptocurrency tokens.

What this essentially means is that they have to consistently monitor the cryptocurrency market and buy a token while its value point is on the lower side, or when it dips in value, then sell it when the price recovers or spikes back up in value.

This is not a strategy suitable for long-term investors, as the goal here is to quickly buy and sell the tokens so that you can have more capital or crypto to make even more purchases going forward; however, it is an excellent opportunity for the short-term and middle-term.

Investing Summarized

Investing is a solid investment strategy for investors who want to pour their capital into projects that they genuinely believe will succeed in the long-term.

What happens here is that investors will buy a specific amount of tokens, after which they will HODL them into their cryptocurrency wallet for potentially a year or multiple years.

The goal here is for the token to increase in value, after which they would sell the token for a profit down the line. However, this is a long-term strategy that should only be utilized in a project that the investor has genuine belief will succeed, so if you are the type of investor that aims to utilize this strategy, make sure that you go over the project’s team, documentation, white paper, overall strategy, tokenomics, and everything else you can gather from it in terms of information.

Trade with DXONE: A trusted, innovative research-based cryptocurrency exchange.

Find us at www.dxone.com Email: marketing@dxone.com

Trade crypto from your smartphone: Download the iOS app or Download App from Google Play

Become a partner: Join us here.

Trading in the crypto market carries risk. Please see our risk warning.